Discover how strategic planning and smart financial decisions can help you achieve long-term financial success. Learn key insights and tools to grow, manage, and protect your wealth effectively.

To create a business budget, start by estimating your income and listing all fixed and variable expenses. Subtract expenses from income.

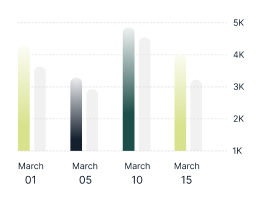

Cash flow refers to the movement of money in and out of your business. Positive cash flow ensures you can cover operational costs.

Build financial stability by maintaining a strong cash reserve, cutting unnecessary costs, managing debt carefully.

Key financial metrics include net profit margin, cash flow, operating expenses, debt-to-equity ratio, and return on investment (ROI).

You should review your budget monthly or quarterly to ensure you're on track with projections. Regular reviews help.

FinTech solutions can streamline financial operations through automation, improve data accuracy, enhance decision-making.